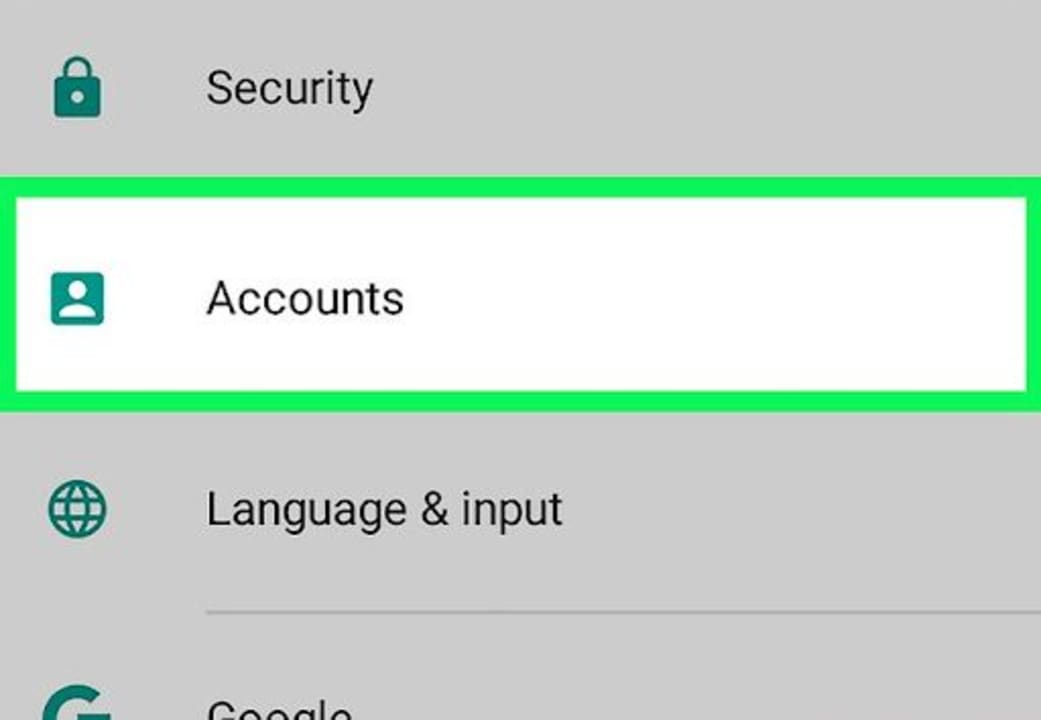

When a trend breaks outside of the channels, it suggests the prior trend could be ending, and that seems to be the case with the 10 Year U.S. The upper and lower channel lines contains 95% of all prices when 2 standard deviations are used. The Lower Channel Line runs parallel to the Linear Regression Line and is two standard deviations below the Linear Regression Line. In the above chart, it's two standard deviations above the Linear Regression Line. The Upper Channel Line is a line that runs parallel to the Linear Regression Line. The Linear Regression Line is mainly used to determine trend direction.Ĭlearly the trend has changed with the yield breaking out above the upper channel.

Best fit means the Linear Regression Line is where there is the least amount of space between the price points and the actual Linear Regression Line. The black line is the yield, and the middle red line is the Linear Regression Line, a straight line that best fits the levels between a starting price point and an ending point. I used Barchart data to create the chart. TNX briefly reached 4.25% in October 2022. Treasury Yield, which is pushing up on 4.00% today, the highest level since 2008 on a monthly basis. When we apply linear regression to capital market trends we are are looking at price and time.īelow is a linear regression of the 10 year U.S. In statistics, linear regression is a linear approach for modeling the relationship between variables. Linear regression analyzes two separate variables in order to define a single relationship. Similar to a moving average, quantitative investment managers may use simple linear regression to define when prices or levels are too high or too low. Linear regression is a statistical method used to predict future trends from past data.

0 kommentar(er)

0 kommentar(er)